稅務規劃

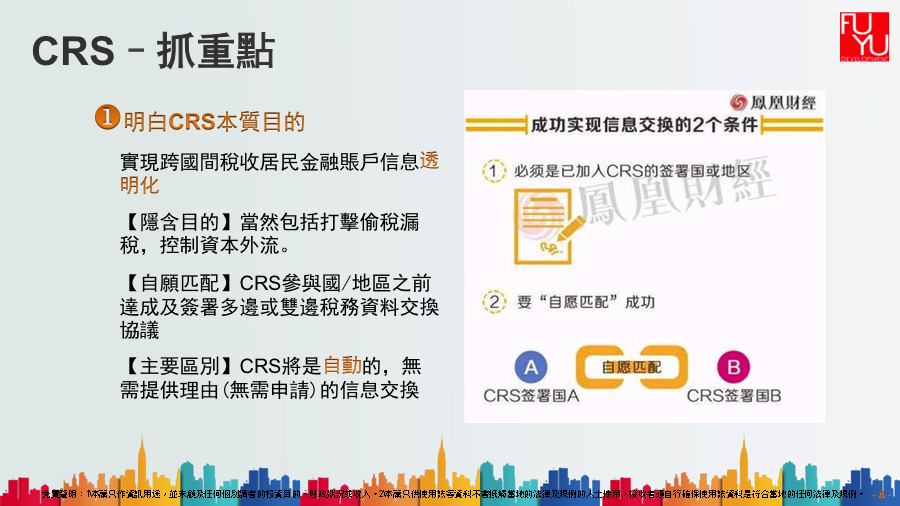

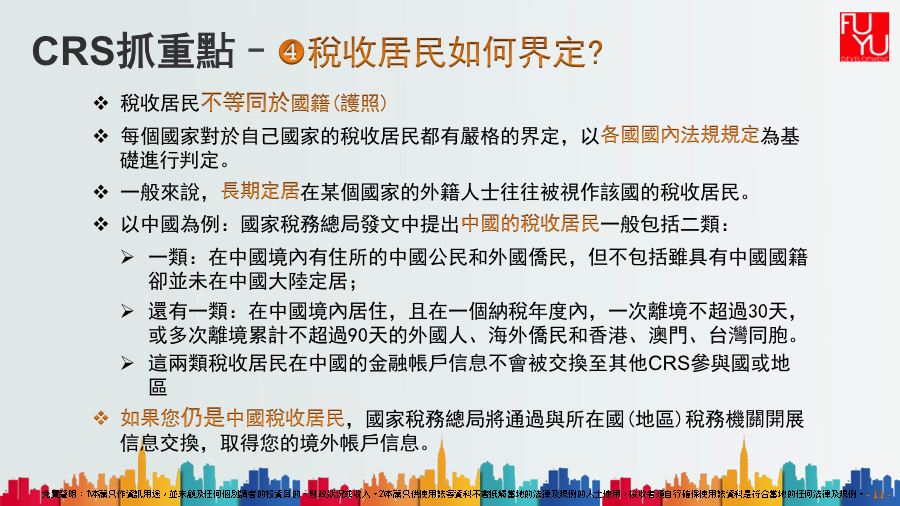

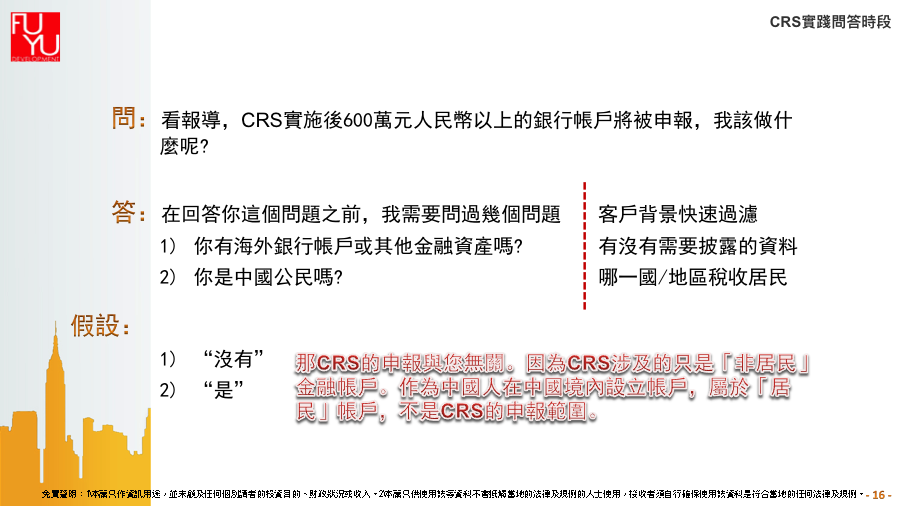

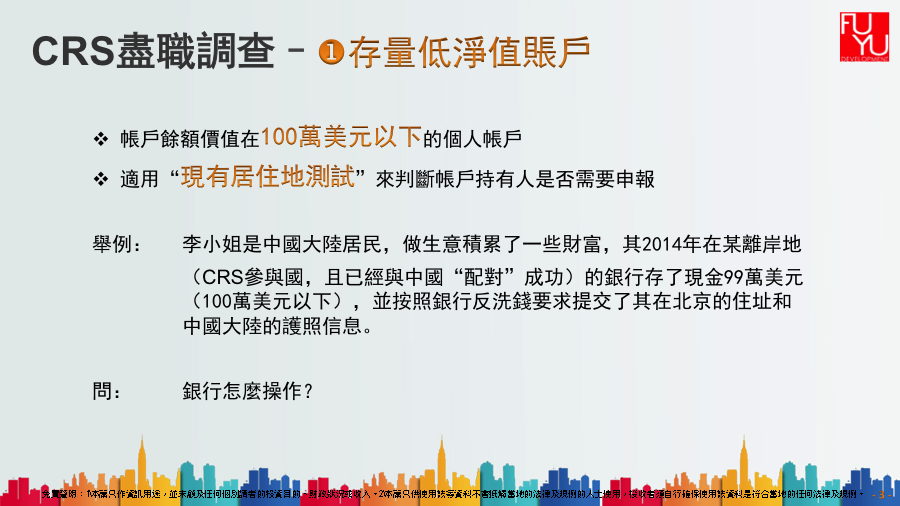

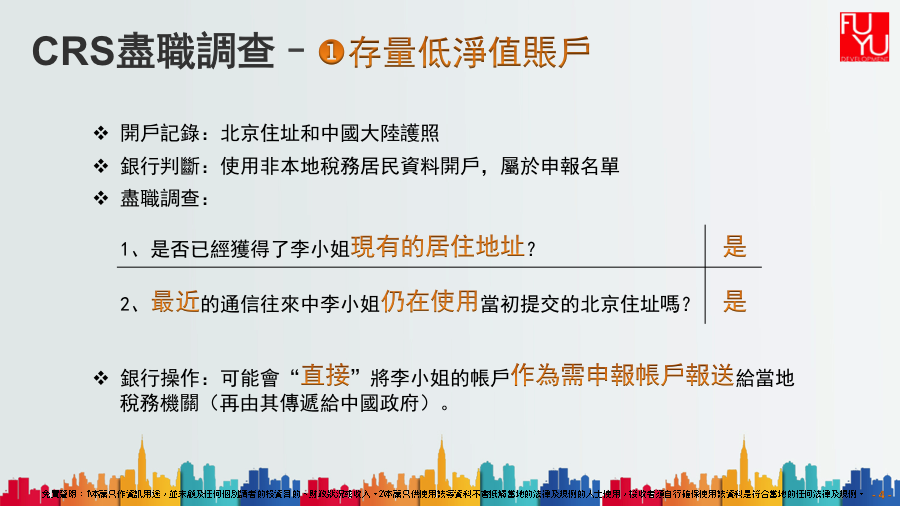

現今提到稅務規劃必定聯繫到CRS這個近期最熱門話題:CRS(Common Reporting Standard)「共同申報準則」。一些移民客戶投資者因此開始擔憂,如果CRS正式實施,是不是會將自己無論在國內,還是香港或者其他國家的所有資產披露無疑,繼而還會被徵稅,補稅?

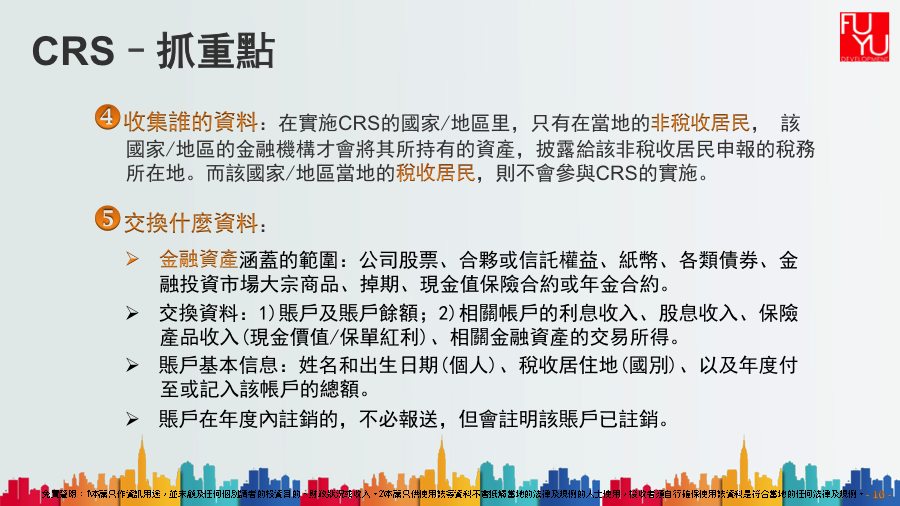

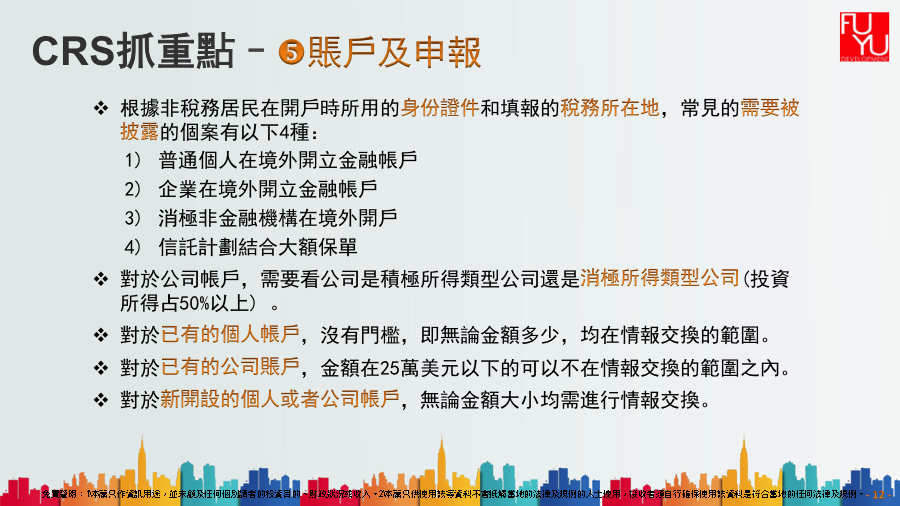

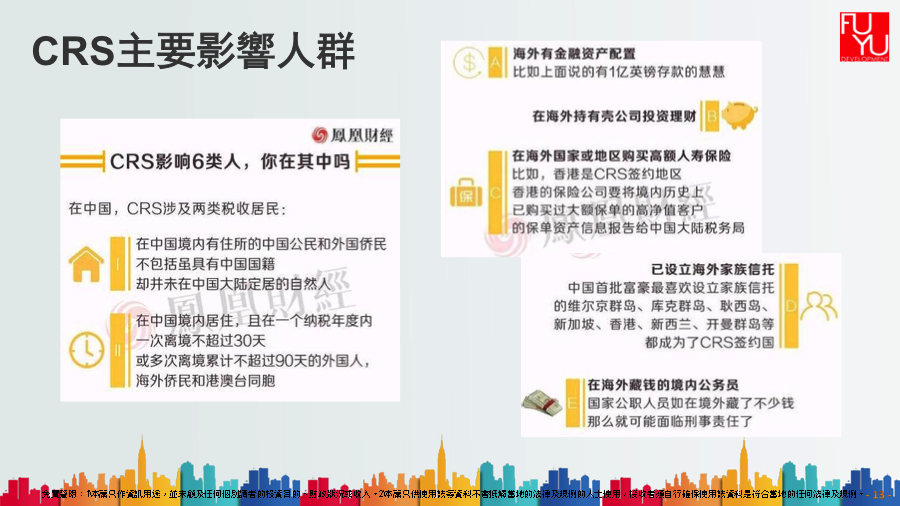

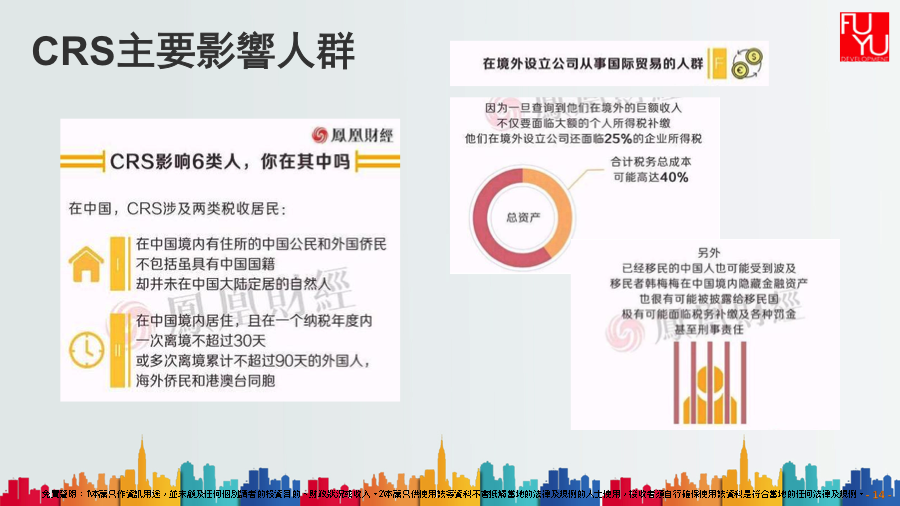

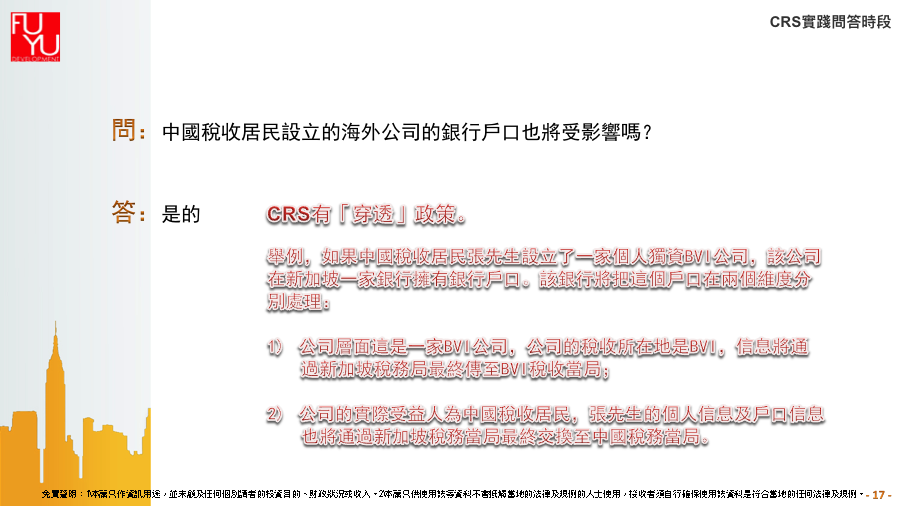

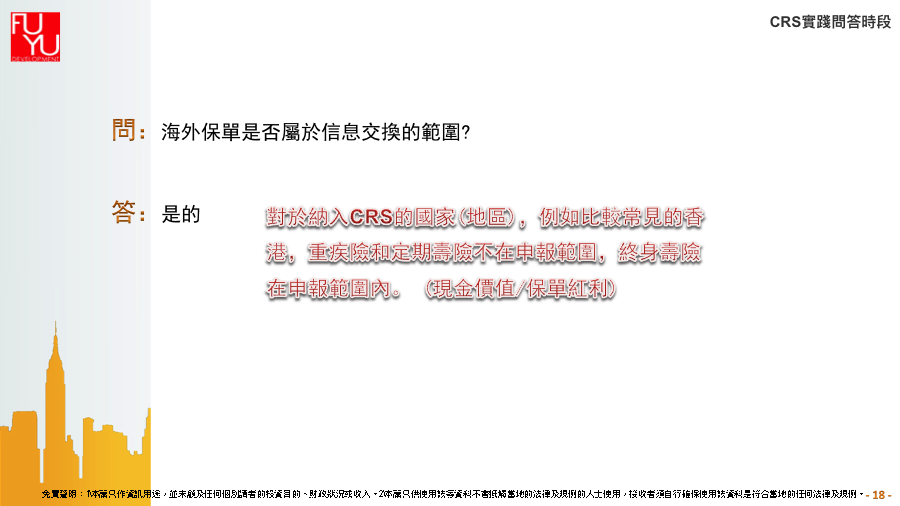

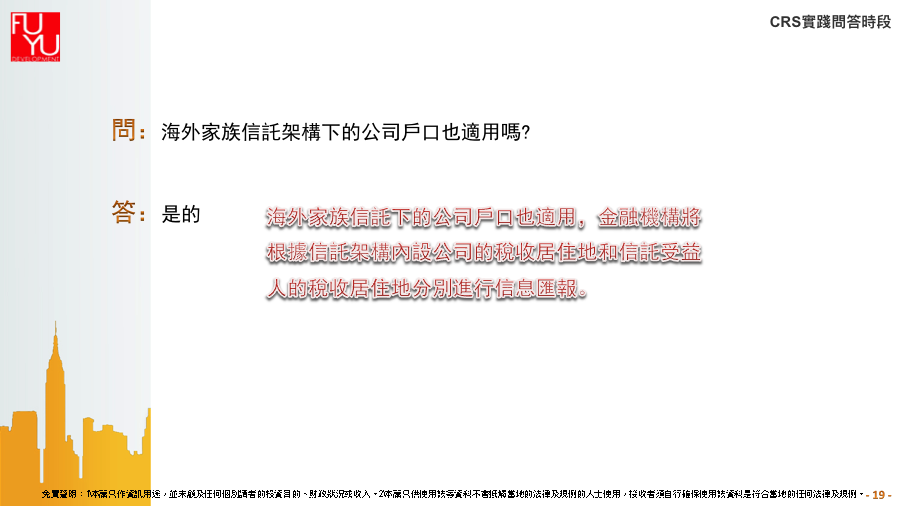

總的來說,CRS將影響全球私人財富結構的所有配置。首先,中國稅收居民設立的海外公司的銀行戶口將受到影響。其次,海外保單、海外家族信託也屬於信息交換的範圍,即使資產被信託持有,但仍然屬於申報的內容之一。

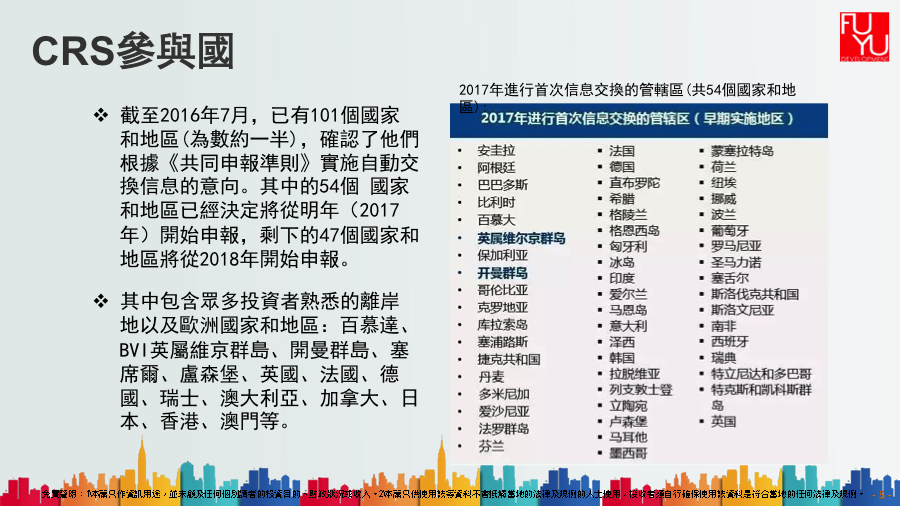

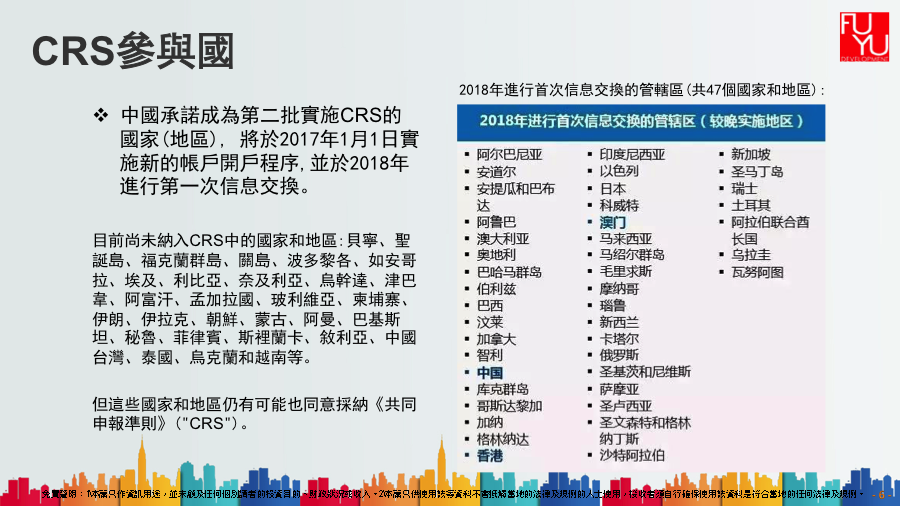

過去的高淨值客戶往往會選擇離岸地來設立信託、私人基金會,因離岸金融擁有在岸金融無法比擬的優點,如稅收低或者零稅收等等。但在CRS的新形勢下,如果離岸地屬於加入CRS的司法屬地之一,那麼離岸金融工具也將作為信息而被申報。一些客戶想通過離岸金融來達到隱匿資產、逃稅將逐漸變的不可能。如果您的國籍所在地參與了CRS,是無法規避CRS的,只能用合適措施來降低CRS所帶來的一些稅務上的風險。對於合法獲取的資產,富有人群更應該積極的進行財富長遠規劃。

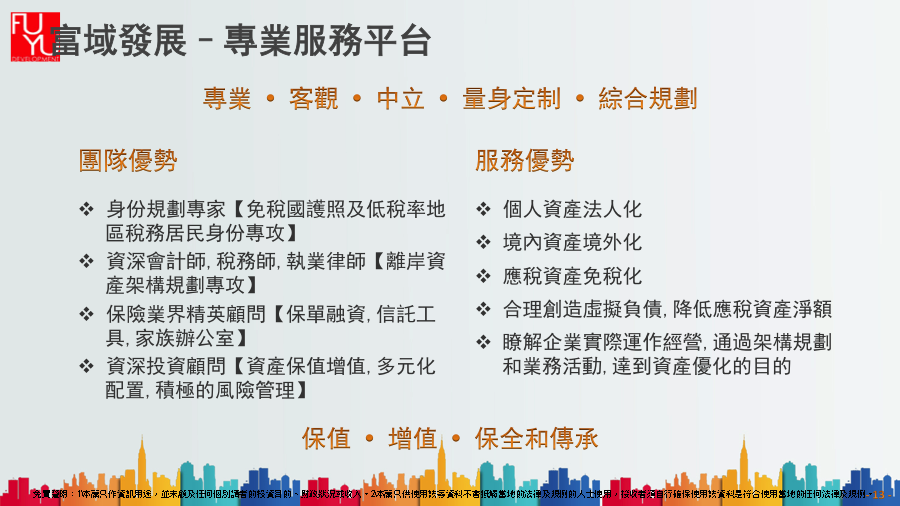

合理合法守護財富必須依靠專業家族財富規劃,比如:

1.香港公司做帳審計、離岸公司正規做帳(審計)。

2.避免自然人直接持股香港公司,讓個人資產法人化。個人資產法人化可延緩納稅,便於日後籌劃,還可降低中港稅務協查帶來的不確定性。

3.資產多樣化配置

4.信託架構

5.身份規劃

6.家族辦公室

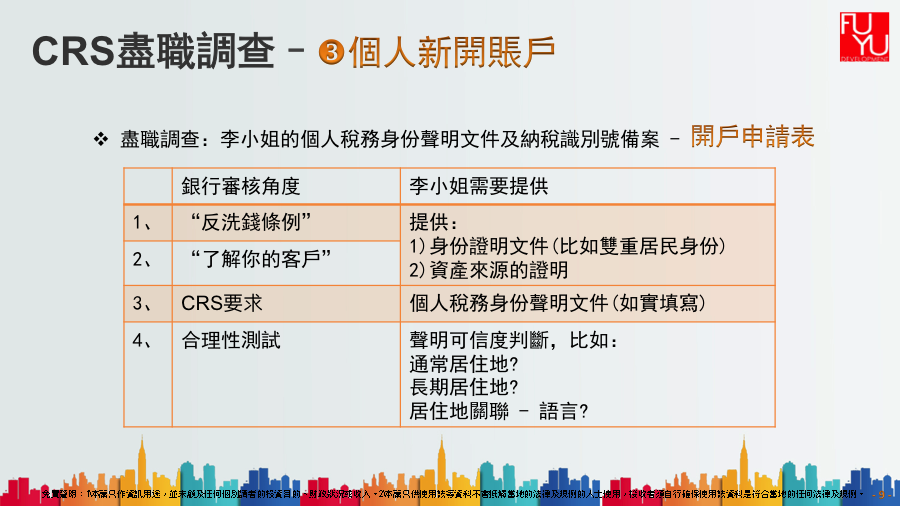

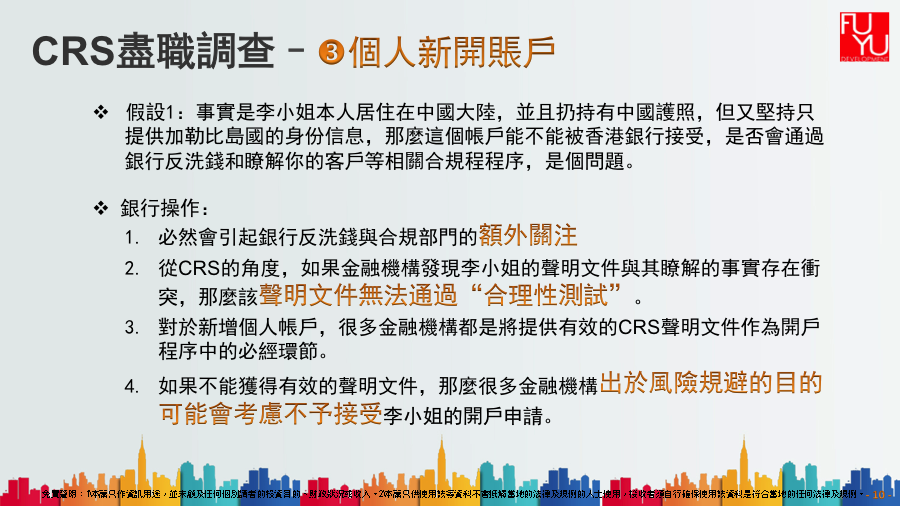

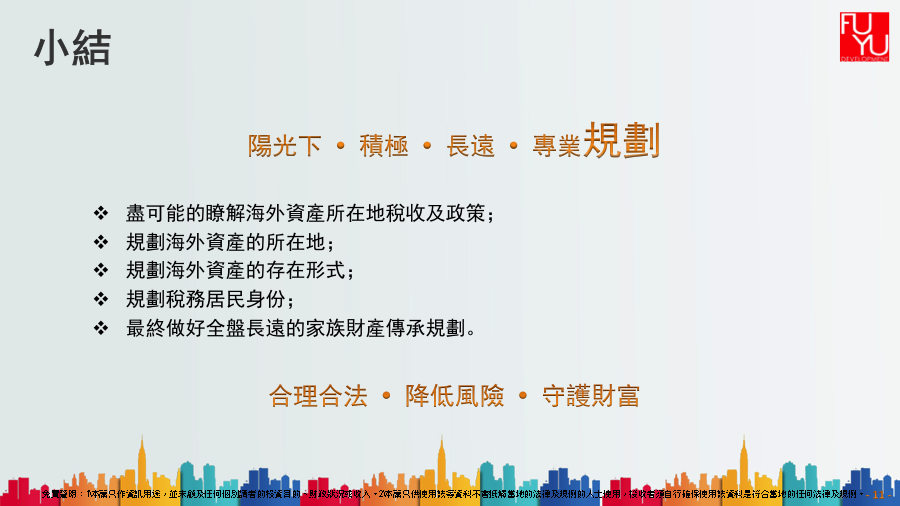

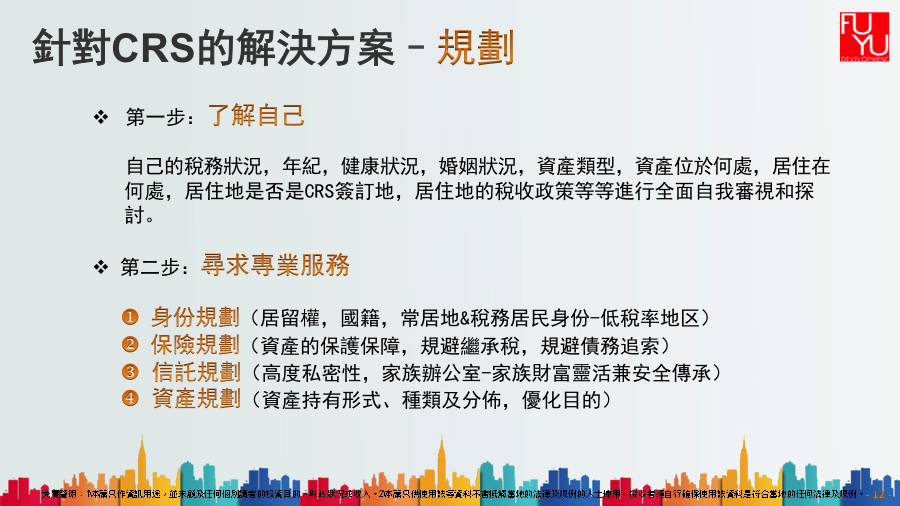

值得提醒的是,CRS應對是一個非常專業的事,因為專業技術要求和信息的壁壘限制,整體稅務規劃是一個複雜又巨大的工程,沒有一簇而就的良藥。正確的方式應該是,盡可能的瞭解海外資產所在地稅收及政策,規劃海外資產的所在地,規劃海外資產的存在形式,規劃稅務居民身份,最終做好全盤長遠的家族財富規劃。

Tax Planning

Today when we talk about tax planning, it surely reminders us about “CRS”, the hot topic in recent. “CRS” stands for the “Common Reporting Standard”. As more and more of our clients are concern about the implementation of CRS, we bring you discussions and solutions related to this topic.

Overall, CRS will affect all configurations of global private wealth structures. First, the bank accounts of overseas companies including offshores that are set up by Chinese tax residents will be affected. Secondly, overseas policies and overseas family trusts are also part of the information exchange, even if the assets are held by the trust, it still need to be declared.

When it is hard to avoid CRS, you can apply appropriate measures to reduce some of the tax risks caused by CRS, and a long-term family wealth planning become more important to wealthy people owning legitimate assets.

The legitimate protection of wealth must depend on a professional family wealth plan, such as:

1. Accounting audit of the company in Hong Kong and regular accounting of offshore companies (auditing).

2. Avoid direct ownership of Hong Kong companies by natural persons and make personal assets corporation

3. Diversification of assets

4. Trust structure

5. Identity planning

6. Family trust

It is important to remind that dealing with CRS demands an overall tax planning; it is a complicated and huge project to which only professionals are competent.

Copyright © 2017 Company, Inc. All Rights Reserved